AXA - EMs trade engine has lost power

Key points

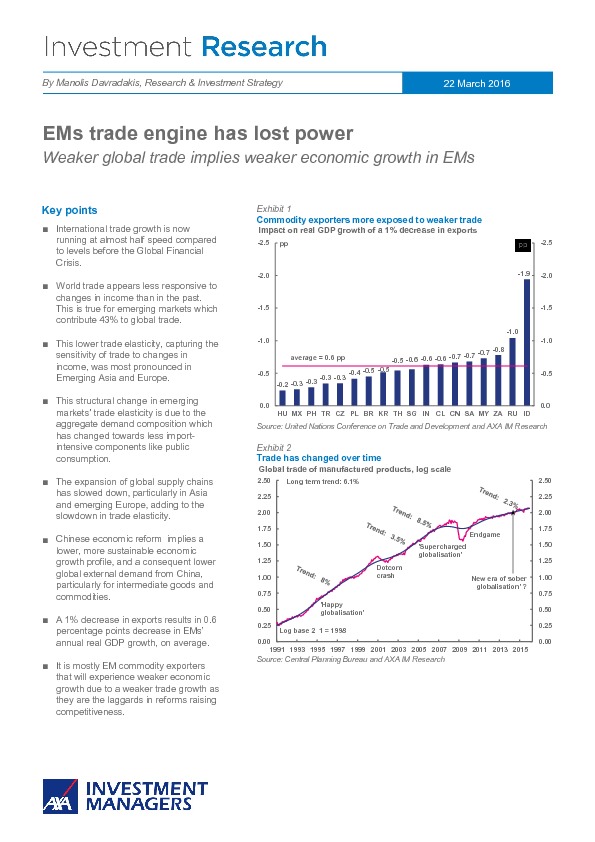

- International trade growth is now running at almost half speed compared to levels before the Global Financial Crisis.

- World trade appears less responsive to changes in income than in the past. This is true for emerging markets which contribute 43% to global trade.

- This lower trade elasticity, capturing the sensitivity of trade to changes in income, was most pronounced in Emerging Asia and Europe.

- This structural change in emerging markets’ trade elasticity is due to the aggregate demand composition which has changed towards less import- intensive components like public consumption.

- The expansion of global supply chains has slowed down, particularly in Asia and emerging Europe, adding to the slowdown in trade elasticity.

- Chinese economic reform implies a lower, more sustainable economic growth profile, and a consequent lower global external demand from China, particularly for intermediate goods and commodities.

- A 1% decrease in exports results in 0.6 percentage points decrease in EMs’ annual real GDP growth, on average.

- It is mostly EM commodity exporters that will experience weaker economic growth due to a weaker trade growth as they are the laggards in reforms raising competitiveness.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.