Fidelity - Market Perspective: The Small Cap Puzzle

At a Glance:

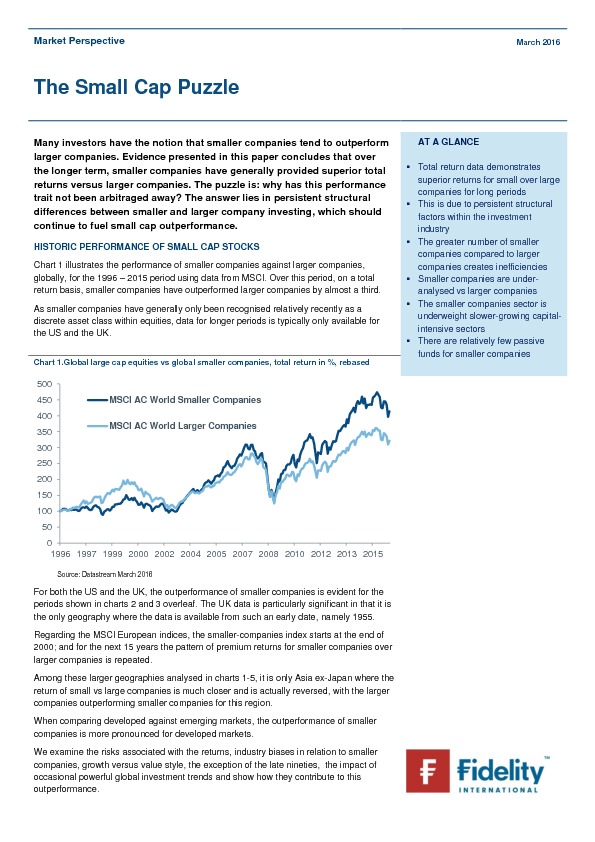

- Total return data demonstrates superior returns for small over large companies for long periods

- This is due to persistent structural factors within the investment industry

- The greater number of smaller companies compared to larger companies creates inefficiencies

- Smaller companies are under- analysed vs larger companies

- The smaller companies sector is underweight slower-growing capital- intensive sectors

- There are relatively few passive funds for smaller companies

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.