AXA - The Federal Reserve's cautious exit

Key points

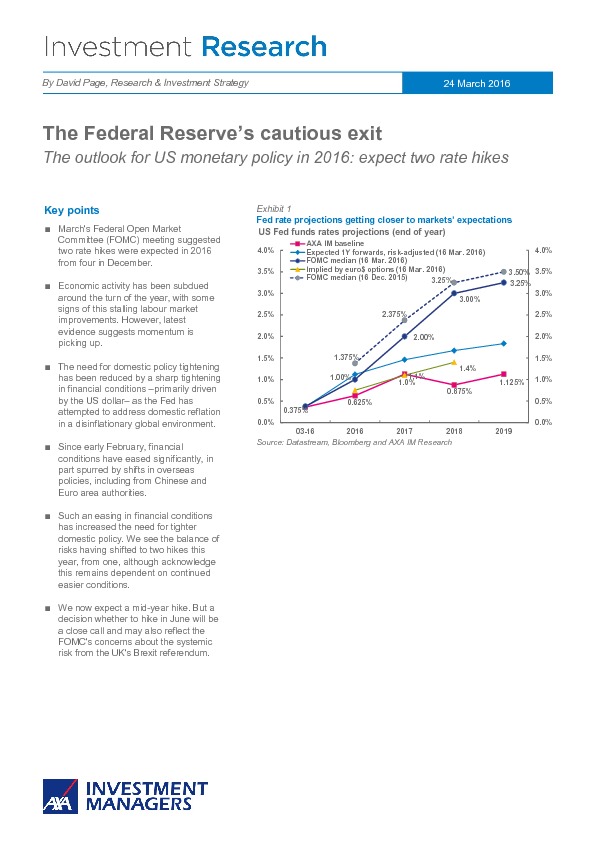

- March's Federal Open Market Committee (FOMC) meeting suggested two rate hikes were expected in 2016 from four in December.

- Economic activity has been subdued around the turn of the year, with some signs of this stalling labour market improvements. However, latest evidence suggests momentum is picking up.

- The need for domestic policy tightening has been reduced by a sharp tightening in financial conditions –primarily driven by the US dollar– as the Fed has attempted to address domestic reflation in a disinflationary global environment.

- Since early February, financial conditions have eased significantly, in part spurred by shifts in overseas policies, including from Chinese and Euro area authorities.

- Such an easing in financial conditions has increased the need for tighter domestic policy. We see the balance of risks having shifted to two hikes this year, from one, although acknowledge this remains dependent on continued easier conditions.

- We now expect a mid-year hike. But a decision whether to hike in June will be a close call and may also reflect the FOMC's concerns about the systemic risk from the UK's Brexit referendum.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.