Valuation Metrics In Emerging Debt

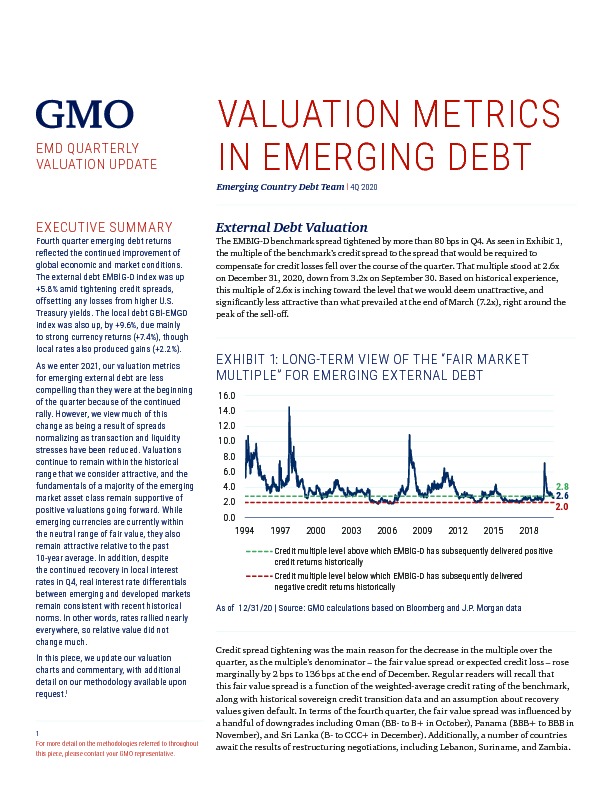

The EMBIG-D benchmark spread tightened by more than 80 bps in Q4. As seen in Exhibit 1, the multiple of the benchmark’s credit spread to the spread that would be required to compensate for credit losses fell over the course of the quarter. That multiple stood at 2.6x on December 31, 2020, down from 3.2x on September 30. Based on historical experience, this multiple of 2.6x is inching toward the level that we would deem unattractive, and significantly less attractive than what prevailed at the end of March (7.2x), right around the peak of the sell-off.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.