Biodiversity bonds

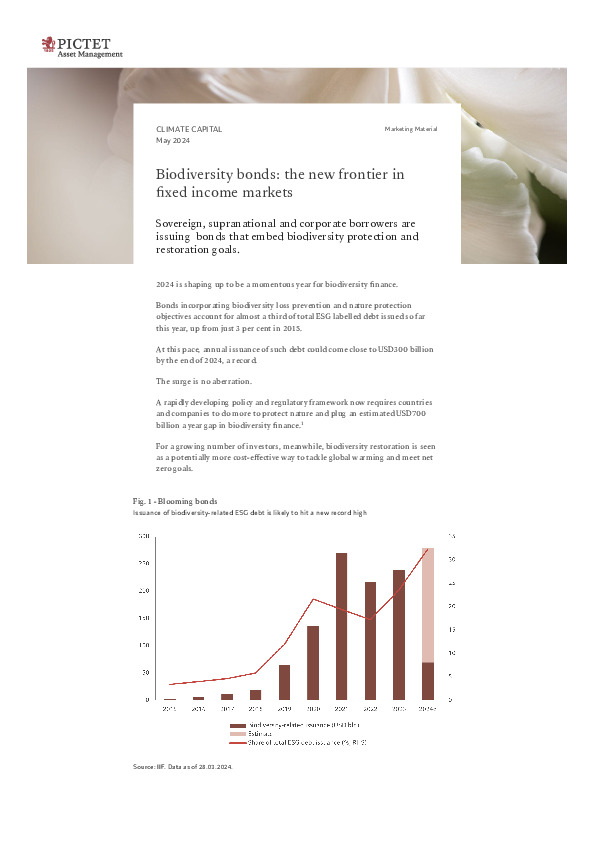

Biodiversity bonds: the new frontier in fixed income markets" explores the rapidly growing trend of bonds that embed biodiversity protection and restoration goals. The article discusses the significant increase in the issuance of such bonds, driven by both policy changes and investor demand. It outlines the emergence of sovereign, supranational, and corporate issuers in this market, highlighting different types of biodiversity bonds and providing case studies of notable issuances. Furthermore, it delves into the financial performance of biodiversity bonds, discussing the concept of a "biodiversity risk premium" and its implications for investors. The article concludes by examining the challenges and potential for further development in the biodiversity finance landscape.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.