BlackRock/iShares - 'Alternative' Ways to Grow Your Portfolio

One of the tried-and-true mantras of investing is the importance of diversification. Filling your portfolio with a mix of different investments is one way to guard against risk on your way to reaching your financial goals. But not all diversification is created equal. Over the past 15 years, a balanced portfolio consisting of 60% stocks and 40% bonds was 98% correlated to stocks, a good thing when markets were on the way up, but not on the way down.

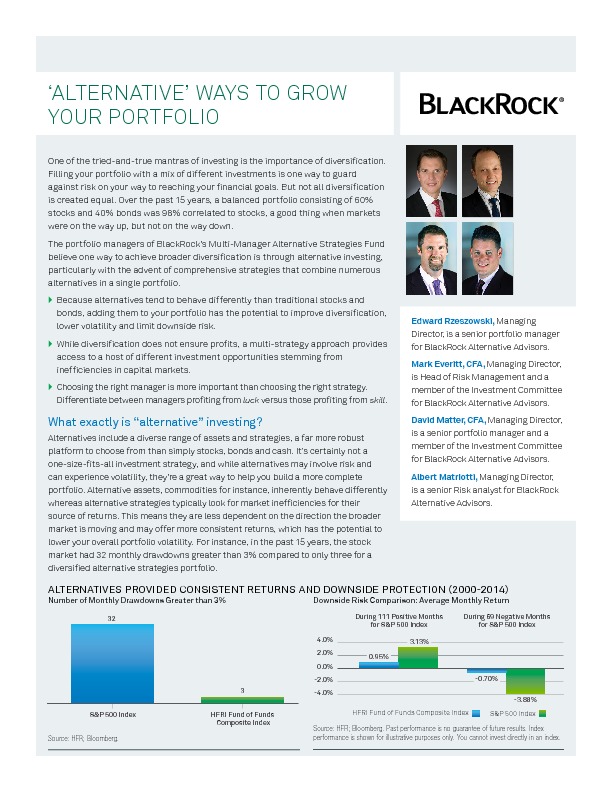

The portfolio managers of BlackRock’s Multi-Manager Alternative Strategies Fund believe one way to achieve broader diversification is through alternative investing, particularly with the advent of comprehensive strategies that combine numerous alternatives in a single portfolio.

- Because alternatives tend to behave differently than traditional stocks and bonds, adding them to your portfolio has the potential to improve diversification, lower volatility and limit downside risk.

- While diversification does not ensure profits, a multi-strategy approach provides access to a host of different investment opportunities stemming from inefficiencies in capital markets.

- Choosing the right manager is more important than choosing the right strategy. Differentiate between managers profiting from luck versus those profiting from skill.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.