AWAITING PEAK HAWKISHNESS

Fixed Income Perspectives

Inflation has remained elevated and the broader economic environment—most notably the labor market—has proved resilient. As a result, central banks remain on a hiking path, with policy rates expected to rise to a higher level than anticipated last quarter. The risk is that they go too far too fast, given that monetary policy impacts the economy with a lag. We think stabilization in markets will require evidence of a peak in inflation, a peak in policy hawkishness and a peak in real yields. Near-term risks are tilted towards another wave of tightening in global financial conditions and the path to peak hawkishness will be challenging, particularly as recession risks rise. As a result, we enter the fourth quarter in a defensive position, remaining overweight the US dollar, while favoring higher quality and less growth-sensitive sectors such as investment grade corporate credit and agency mortgage-backed securities (MBS).

”Valuations have reset lower but rising real yields remain a headwind. Once we have clearer evidence of a peak in inflation—and in turn policy tightening and real yields—we think the current risk premiums will create an alpha tailwind for active investors.”

- Sam Finkelstein

”Higher inflation and higher growth volatility are propelling us into a higher yield environment, marking a departure from the post-financial crisis era. Ultimately, we think this presents opportunities in high-quality fixed income assets, such as investment grade corporate bonds and agency MBS.”

- Whitney Watson

Macro at a Glance

Growth

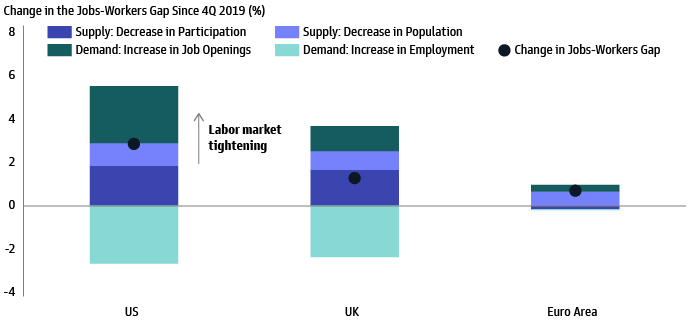

As discussed in our Fixed Income 3Q Outlook: Navigating Expeditious Tightening, a soft landing requires policymakers to slow growth to below potential to loosen the labor market enough to temper wage growth and inflation. Heading into the fourth quarter, the persistence of inflation and continued policy tightening raises the risk of recession. Europe faces the added challenge of energy supply and cost issues, while China looks set to grow just 3% this year, owing to weakness in the property sector and ongoing Covid-related activity restrictions. In the UK, growth support from fiscal easing is somewhat offset by the need for further policy tightening.

Tight Labor Markets are Driven by Both Supply Issues and High Demand

Source: Goldman Sachs Global Investment Research. As of September 6, 2022.

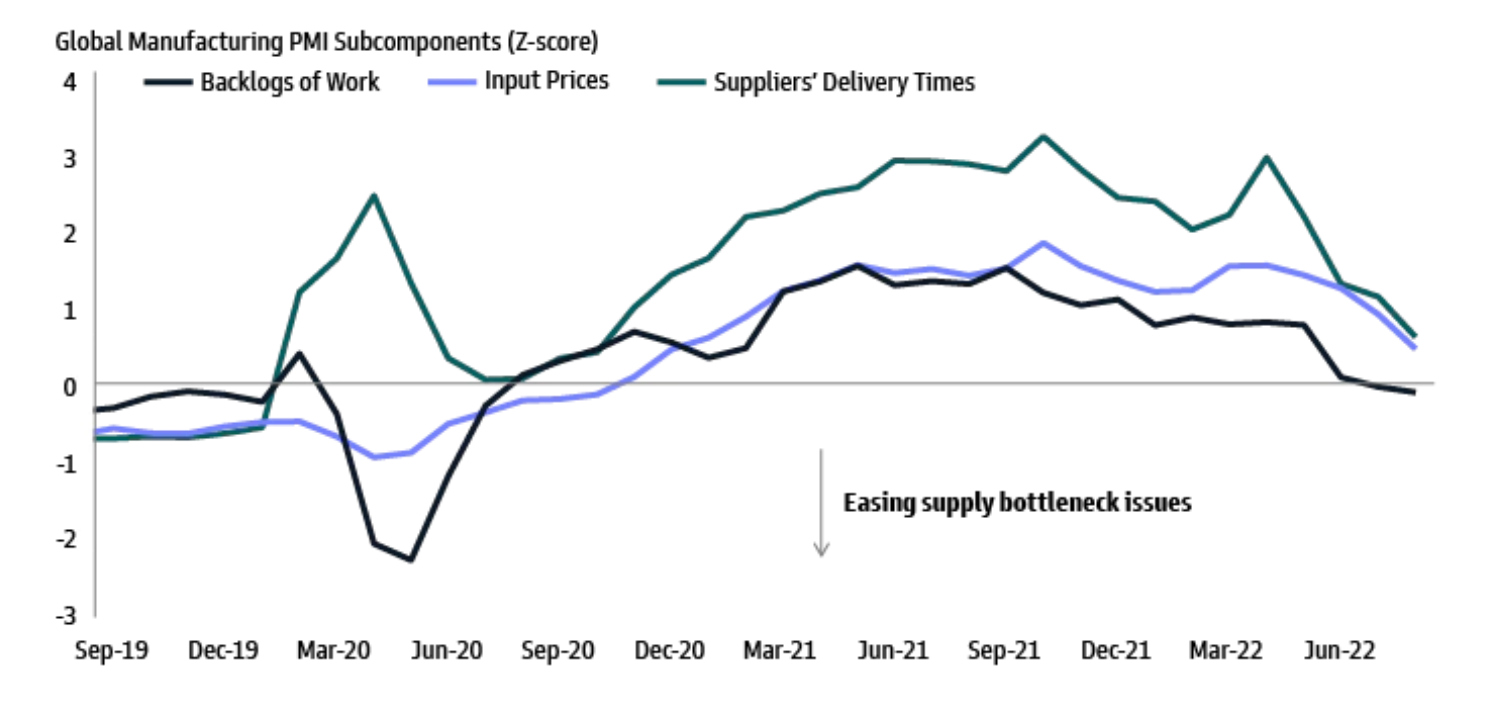

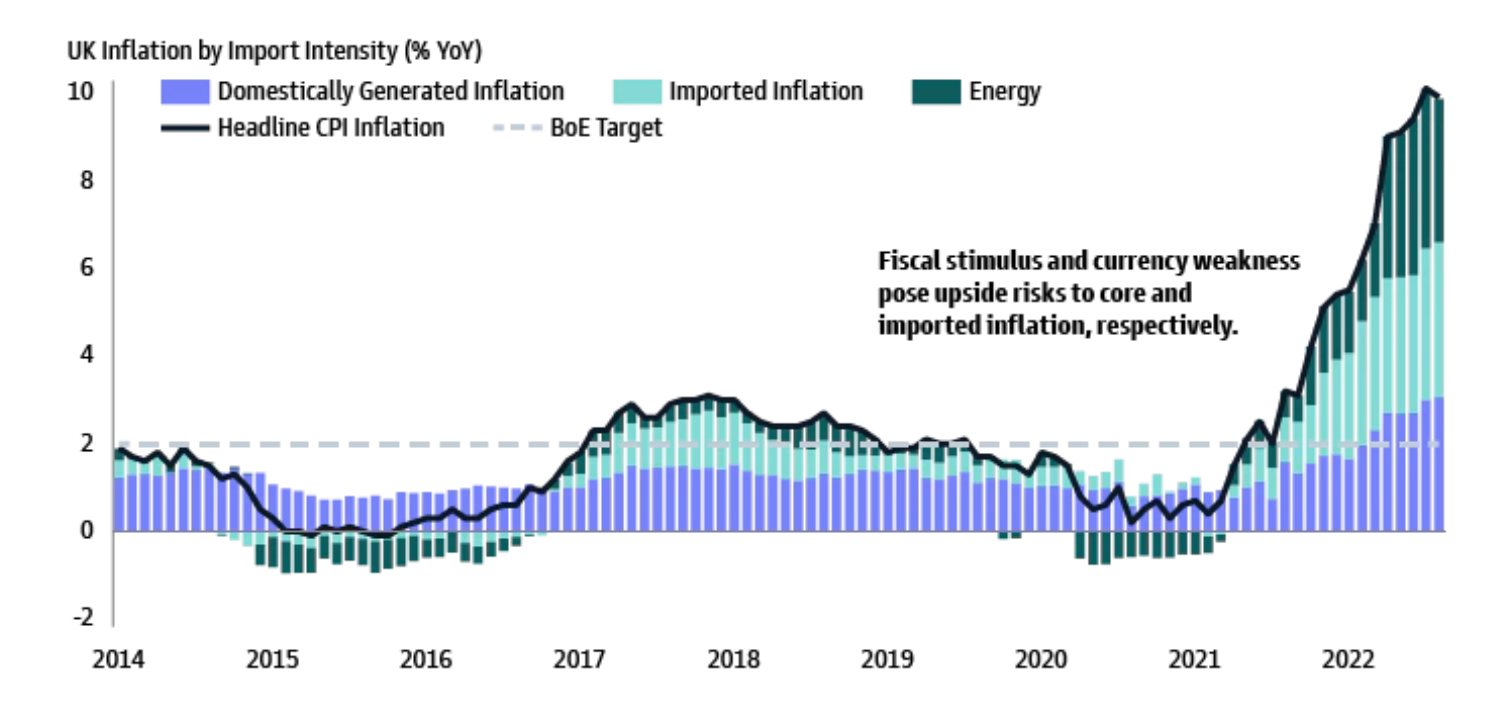

Inflation

In line with our expectations, goods inflation is moderating due to normalizing demand, easing supply chain issues and lower commodity prices. However, services inflation such as rents remains firm, particularly in the US. UK inflation will likely peak at a lower level, owing to the energy price cap, while Euro area inflation continues to surprise on the upside, reaching new all-time highs in August. We are closely monitoring labor markets for signs of loosening and evidence of easing inflation pressures across both core goods and core services as the impact of policy tightening begins to take hold.

Easing Supply Chain Issues Offer Some Relief to Goods Inflation

Source: Macrobond, Markit, Goldman Sachs Asset Management. As of August 2022.

Policy Picture

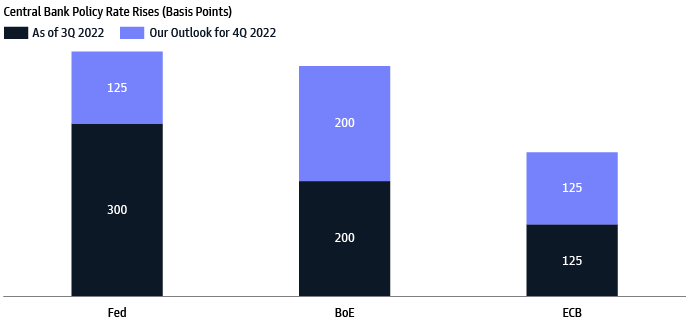

Monetary

Our outlook for major central banks has reset in a hawkish direction yet again. The Fed has signalled a further 125bps of rate increases by the end of the year, European Central Bank (ECB) communications have turned increasingly hawkish, and the Bank of England (BoE) looks set to accelerate its pace of tightening given upside risks posed by currency weakness and proposed fiscal stimulus. Even the Bank of Japan (BoJ), a notable dovish outlier, could retrench from ultra-easy policies such as yield curve control in the coming months. Insofar as higher Japanese government bond yields motivate repatriation of Japanese investor capital, global term premium may face a fresh upward impulse.1

Central Banks Continue to Climb Rate Hiking Cycles

Source: Macrobond, Goldman Sachs Asset Management. As of October 1, 2022.

Fiscal

European governments have intervened to shelter households (and to a lesser degree firms) from high energy prices. Euro area measures amount to around 2.5% of GDP, with additional support likely to come from spending linked to revenue received from windfall taxes.2 The UK has announced large-scale tax cuts in addition to a two-year cap on household energy prices. The measures may support growth and lower the peak in headline inflation but imply upside risks to core inflation, complicating the BoE’s task of taming inflation. Notably, UK and EU interventions still imply higher energy costs relative to a year earlier, suggesting some degree of demand destruction over the winter.

UK Fiscal Easing and Currency Weakness Raises Inflation Risks

Source: Macrobond, Goldman Sachs Asset Management. As of August 2022.

Navigating Fixed Income

Fixed Income Spread Sectors

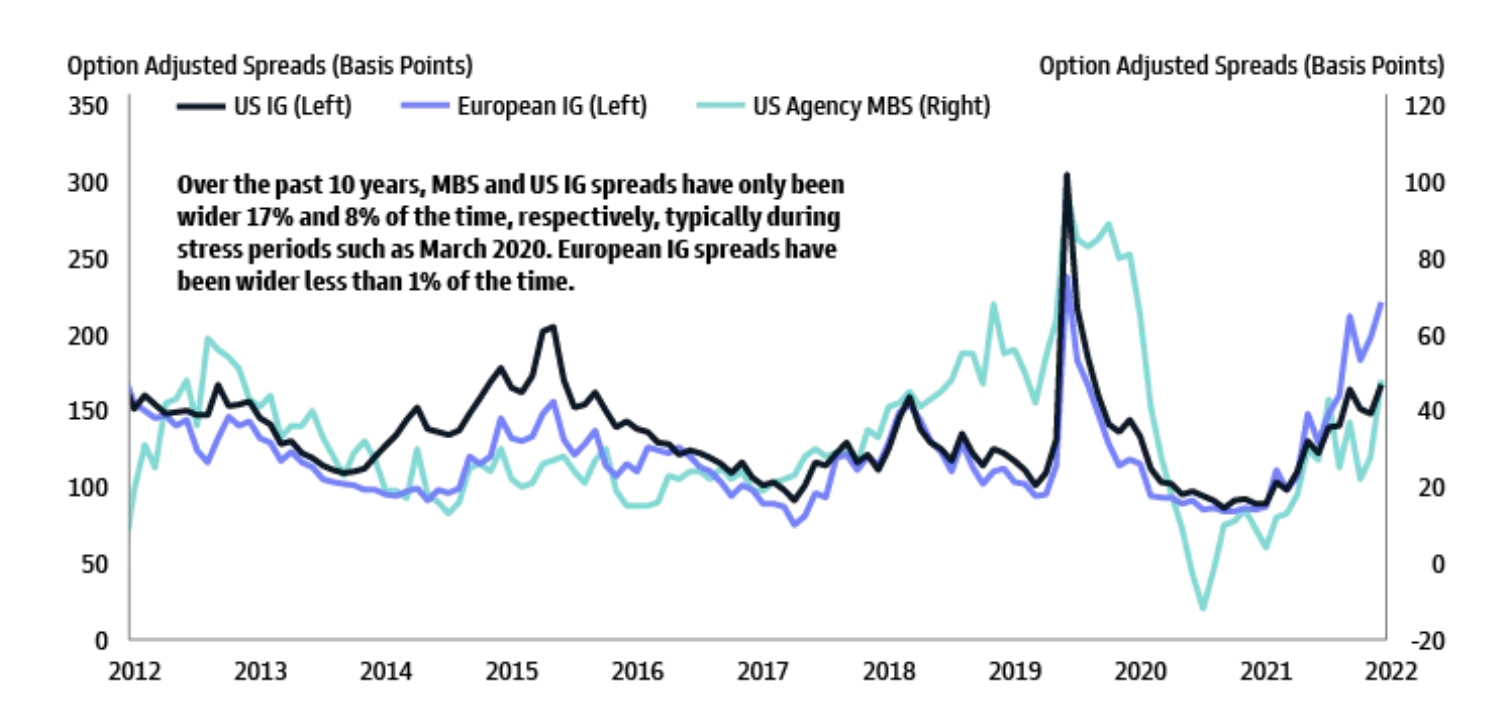

Asset Allocation: Although valuations have reset lower since the summer relief rally, the road to peak hawkishness will likely be challenging for most financial assets, particularly as recession risks rise. As a result, our asset allocation across spread sectors is defensive and up-in-quality. Specifically, we see value in investment grade corporate bonds and agency MBS given their lower sensitivity to growth weakness and our view that spreads are wide relative to underlying fundamentals.

Portfolio Balance: In a high inflation environment, a “balanced portfolio” that combines exposure to spread sectors with interest rates can lose its balance as the rates-credit correlation turns less negative or even positive. Considering this, we are no longer balancing fixed income portfolios with interest rates.

EM Spotlight: In our view, EM corporate debt is a bright spot in the EM universe. Companies display strong fundamentals, and their bonds offer an attractive yield premium over comparable rated DM peers. The departure of challenged issuers—largely from the China property sector and Russia—has improved the quality of the sector’s benchmark and EM companies have displayed credit resilience even in the face of sovereign level credit stress. The sector also offers attractive alpha potential for active investors due to investor segmentation and lower research coverage relative to other asset classes.

Macro Markets

We remain overweight the US dollar given it is a beneficiary of both Fed tightening and recession concerns. Elsewhere, we hold moderate exposure to DM sovereign bonds as the current environment of high inflation, relatively flat yield curves and synchronized central bank tightening limits both the directional and relative value opportunity set. That said, we are underweight Japanese rates as we think a combination of reduced deflation risks, global pressures and currency weakness could prompt the BoJ to begin to depart from its ultra-easy monetary policies.

High Quality Fixed Income Spreads Appear Wide Relative to Fundamentals

Source: Macrobond, Goldman Sachs Asset Management, ICE BofAML Indexes. As of September 29, 2022.

Sustainability Spotlight

Europe’s New Energy Reality

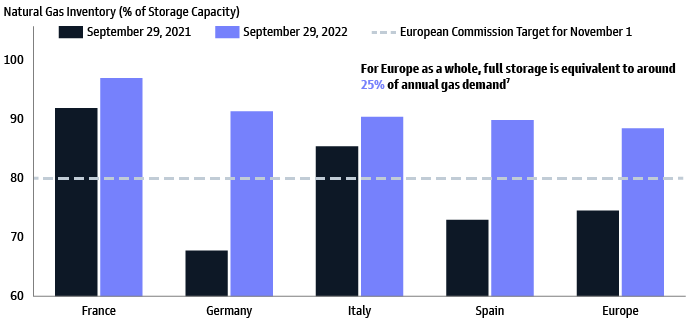

Near-Term Challenges: Limited long-term gas contracts and reliance on Russia has left Europe vulnerable to soaring natural gas prices. As highlighted in our weekly MusinGS (September 9 and July 15), the near-term response has entailed a degree of demand destruction, supply substitution (including delayed closure of coal plants and nuclear reactors), rising storage reserves, energy price caps and targeted support for corporates. Near-term risks to supply and gas prices include a colder-than-average winter, higher China demand and an escalation in geopolitical tensions.

Longer-Term Opportunity: Europe has an opportunity to leverage the current challenges to build a more sustainable energy system for the future, improving energy affordability, the region’s balance of payments, security of supply and creating domestic employment in key clean tech innovation areas.5 Globally, clean energy jobs already account for more than half of employment in the energy sector6 and the European Union’s REPowerEU program, which places emphasis on energy efficiency targets, will likely drive up demand for highly-skilled clean energy workers in the region. For fixed income investors, as noted in Europe Recovering Into A New Regime, positive yields and structural reform focused on energy transition and digitization may offer bottom-up corporate bond opportunities, particularly in green bonds issued to strengthen resilience to physical climate risks, and accelerate the energy transition.

A Cold Winter Could Still Present Challenges Despite High Gas Storage

Source: Macrobond, Goldman Sachs Asset Management, European Commission (EC), Gas Infrastructure Europe. As of September 2022.